Last Friday, we held a new edition of the TechTur Legal Series, the webinar cycle of the Tech Tourism Cluster focused on legal and tax topics of high relevance to the traveltech sector.

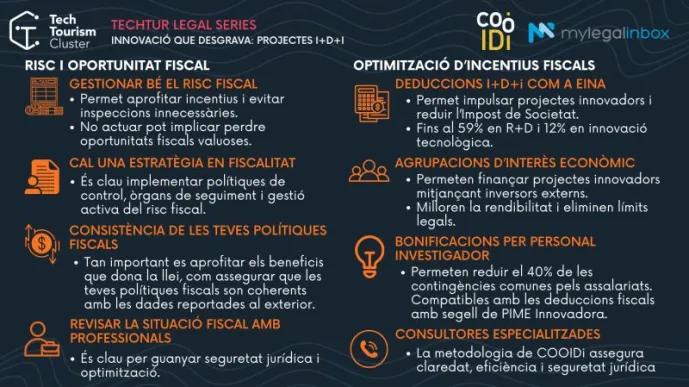

Under the title "Tax-Savvy Innovation: R&D&I Projects", the session explored how to manage fiscal risk and maximize the benefits that legislation offers to innovative companies.

The first part, titled "Balancing Fiscal Risk and Opportunity", was led by Mauro Rilova from Mylegalinbox, who emphasized the importance of good corporate governance and a well-defined tax strategy to avoid unnecessary audits and take advantage of valuable incentives. He also stressed the need for consistency between internal tax policies and external reporting, as well as the value of professional support to ensure legal certainty.

Next, Arnau Martín and Xavier Sarrà from COOIDi Consultors presented the main types of tax deductions for R&D&I projects, with a special focus on tech companies. Key points included:

• Tax deductions of up to 59% for R&D and 12% for technological innovation

• Social Security bonuses for research staff

• The key role of economic interest groups as a tool to attract external investment

• And the importance of working with specialized consultancies to ensure efficiency and legal security

Participating companies had the opportunity to raise their questions and concerns directly with the speakers, making the session both practical and interactive.

At the cluster, we will continue creating learning spaces on taxation and legal matters applied to the tourism tech sector, aiming to foster the growth and competitiveness of our ecosystem.

📩 Interested in other legal or tax-related topics? Reach out and help us shape the next TechTur Legal Series!

Author

Recent posts

05 February 2026

26 January 2026

18 December 2025

Subscribe

Subscribe here and stay tunned on what's next